Toggle intro on/off

Insights from Amazon's FY24 result

Marketplace consolidation

19 March 2025

Christmas 2024 retail feedback

Santa delivers the goods

07 January 2025

Amazon prefers 3P sales

Online retail poses lower margin risk

08 October 2024

Coles (COL) 1Q24 sales insights

Slowdown triggers cost focus

27 October 2023

Australian retail sales for August 2023

A low point may be near

09 October 2023

Outlook for Black Friday 2022

The rise of November promotions

17 November 2022

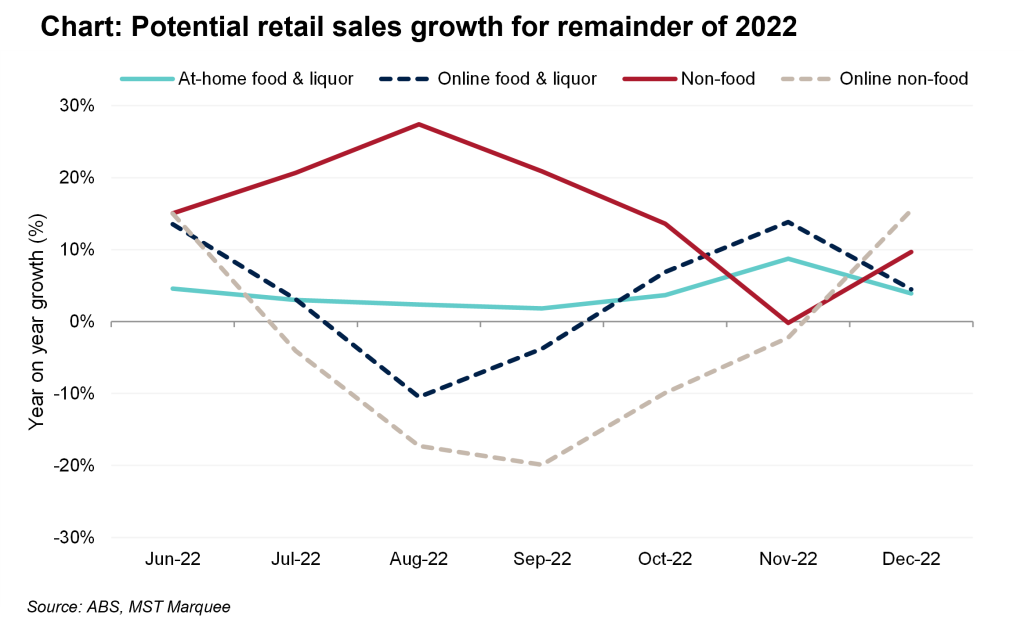

Retail sales outlook for remainder of 2022

What to expect over coming months

21 October 2022

Quarterly update: Retail sales forecasts for FY23e

Don’t dismiss the influence of inflation

16 October 2022

Australian supermarkets - The normalisation in supermarkets

Independents holding onto gains

07 September 2022

Retail sales for June 2022

Resilience on display

03 August 2022

Search result for "" — 480 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.