Retail sales for May 2024

Faint pulse emerging

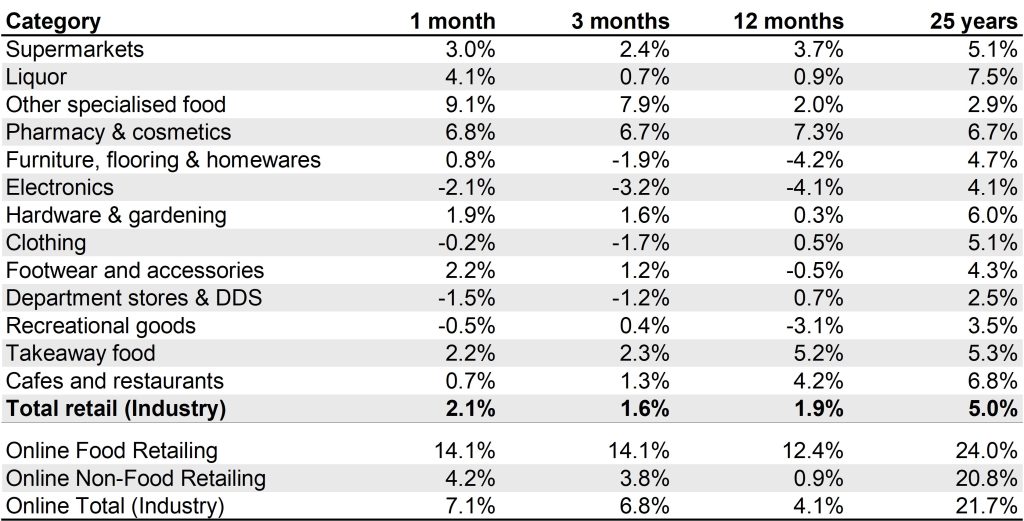

Australian retail sales rose 2.1% year-on-year in May 2024, which is the best underlying rate of growth since November 2023. The glass half-full would suggest we may be past the trough for retail. The glass half-empty is that the rate of growth is still very weak and indicative of per capita declines in retail volumes. We do think we are now past the trough in volumes, but we don’t expect a swift recovery in retail spending.

What we’re seeing and hearing in retail

- Sluggish sales trends: Our feedback across a wide range of categories indicates like-for-like sales are down for many, but only low single-digits.

- Trading down more apparent: Retail volumes are stabilising. However, the retail pressure is shifting towards trading down behaviours, which is lowering the average transaction value. Trading down pressure is likely for another 12 months.

- Freight rates: Spot sea-freight rates have spiked higher again in the past month. Retailers tend to have contracts, but spot rates are now close to 2x contract rates.

Sub-sector insights

- Supermarkets: Supermarket sales rose 3.0% relative to 2.0% growth in Easter months of March-April. Volumes per capita are still in decline given food CPI of 3.3%. ALDI is still taking share from the majors.

- Liquor: Liquor sales were up 4.1%, coming off a weak Easter period down -0.9% for March-April. This growth implies some volume recovery in May.

- Takeaway food: Takeaway food sales rose 2.2%. Given CPI is running at 5%-6% in fast food, volumes are clearly in decline.

- Pharmacy & cosmetics: Pharmacy sales rose 6.8%, which makes it the fastest retail segment. While growth is good, trends have slowed from 8%-10% in recent months. A further slowdown is likely as price inflation fades.

- Electronics: Electronics sales dropped 2.1% in May 2024. Our feedback suggests the television category is the weakest and trading down is dragging on revenue.

- Hardware and furniture: Hardware sales rose 1.9%, slowing from 4.1%. Metcash trading update was negative for hardware. Total Tool LFL sales were down 3.3% for the seven-week period in May and June. Furniture rose 0.8%, turning positive ahead of the important EOFY sales in June.

- Recreational goods: Recreational goods sales fell 0.5%. Bigger ticket items such as gym equipment and camping are in decline.

- Department stores: Dept stores and discount department stores fell by 1.5%. We have heard that Kmart’s outsized sales trends have slowed, albeit it is still winning share. Big W, Target, David Jones and Myer are all in negative comp territory.

- Fashion: Clothing sales dropped 0.2%, footwear and accessories were up 2.2%. We are seeing solid casual footwear demand, despite Nike’s weakness.

- Online retail: Online sales rose 7.1% with the strongest underlying growth in non-food online we’ve seen in 12 months. Growth is likely to accelerate.

Chart: Australian retail sales long-term trend

Source: ABS, MST Marquee

Not already a member?

Join now to get all the latest reports in full and stay informed.