Toggle intro on/off

Woolworths (WOW) January 2024 trading update

Difficult outside the core

31 January 2024

Australian supermarkets - grocery perspectives

Prices, profits and government scrutiny

31 January 2024

Woolworths (WOW) 3Q23 result insights

Inflation support is softening

04 May 2023

Metcash (MTS) 1H23 result insights

The benefits of inflation

05 December 2022

Woolworths 1Q23 result insights

It gets better from here

05 November 2022

Coles 1Q23 result insights

A low point in sales growth

28 October 2022

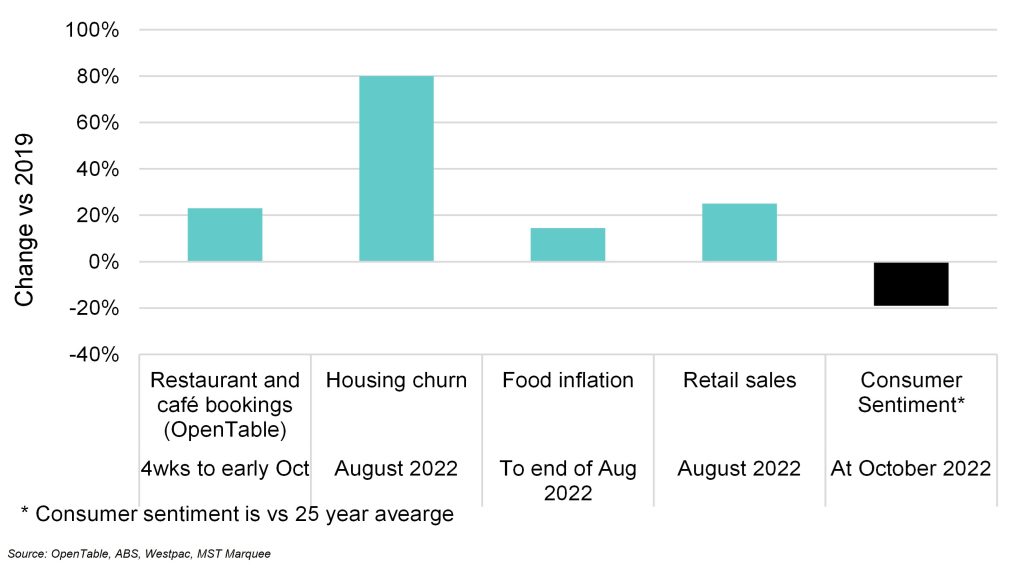

Measuring consumer behaviour vs consumer sentiment

The potential disconnect

12 October 2022

Coles (COL) and Woolworths (WOW) supermarkets

A better inflation outlook

01 February 2022

Metcash (MTS) Stabilising market share

Steady share with inflation upside

16 November 2021

Coles (COL) and Woolworths (WOW) 1Q22 sales preview

Is it lockdown or something else favouring Woolworths?

21 October 2021

Search result for "" — 362 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.