Toggle intro on/off

The Retail Mosaic Issue 5

Australia vs New Zealand retailing - Are there parallels across the ditch?

10 December 2022

Retail sales for October 2022

Moderating lockdown distortions

05 December 2022

Retail sales for September 2022

Online normalisation continues

05 November 2022

Measuring consumer behaviour vs consumer sentiment

The potential disconnect

12 October 2022

Retail sales for August 2022

Online sales decline

06 October 2022

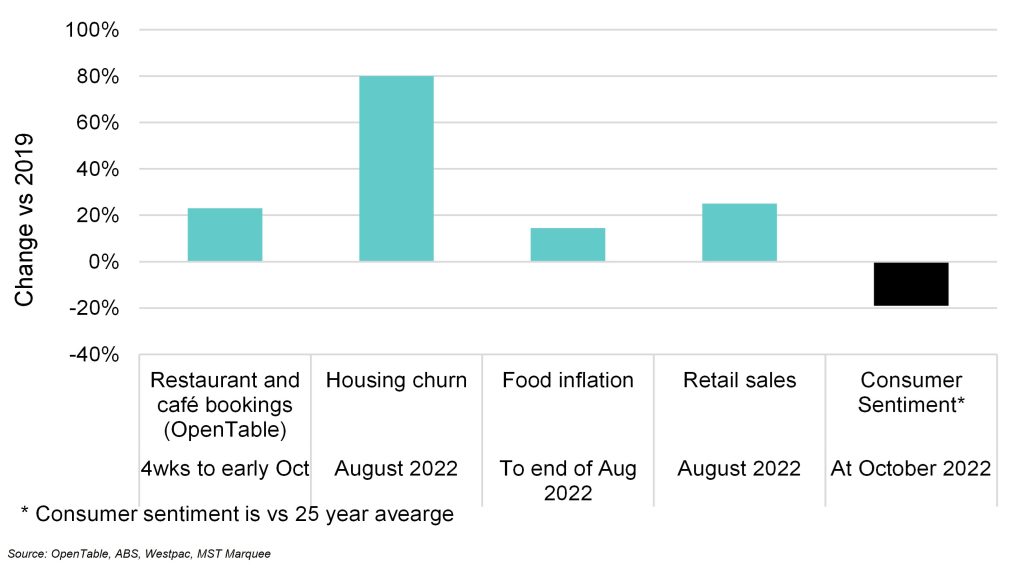

What correlates with retail sales?

The disconnect between sentiment and spending

26 September 2022

Search result for "" — 362 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.