Toggle intro on/off

Super retail (SUL) April 2023 trading update

Starting to see sales shift

05 May 2023

JB Hi-Fi (JBH) 3Q23 results insights

Sales decline now underway

05 May 2023

Endeavour Group (EDV) 3Q23 sales result

Mixed signals in its sales recovery

04 May 2023

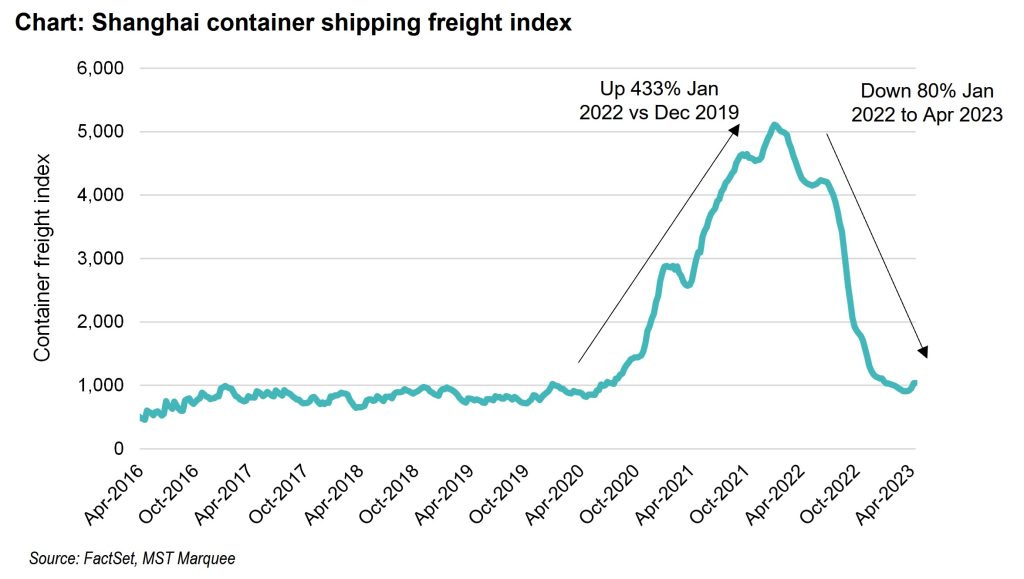

Shipping costs fall back to 2019 levels

The impact on retail inflation

24 April 2023

Retail forecasts for 2023

Brace for impact this year

11 January 2023

JB Hi-Fi 1Q23 sales insights

Double-digit growth now over

31 October 2022

The Retail Mosaic Issue 4

The role of China in Australian retail - the risks and benefits in offshore sourcing

13 September 2022

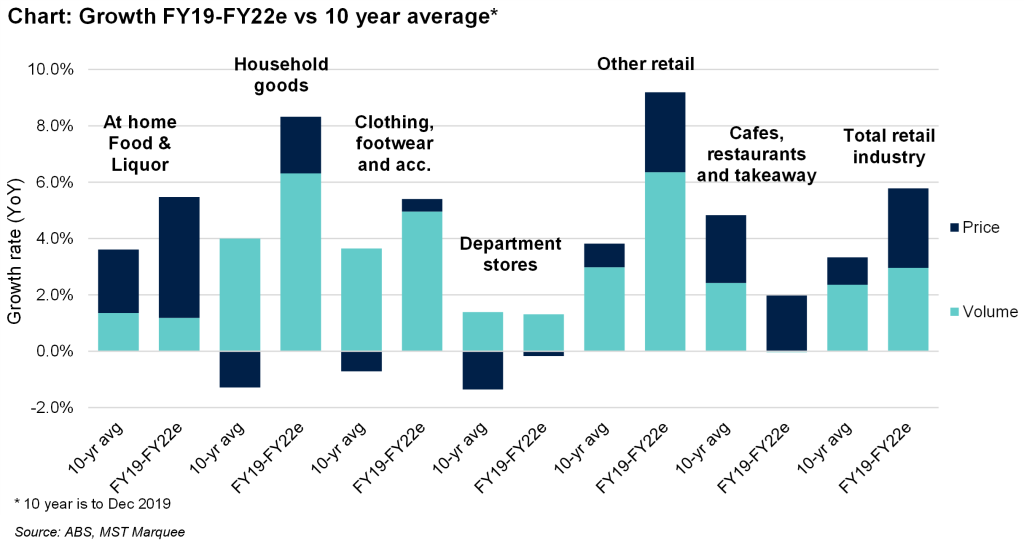

The contribution of price to revenue growth in retail

What mean reverts, price, volume or both?

05 August 2022

Supermarket margins up

Shaping up as a good FY23e

04 August 2022

Retail sales forecasts for FY23e

Weaker growth, but inflation is a cushion

20 July 2022

Search result for "" — 471 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.