Toggle intro on/off

The need to diversify supply chains for Australian retailers

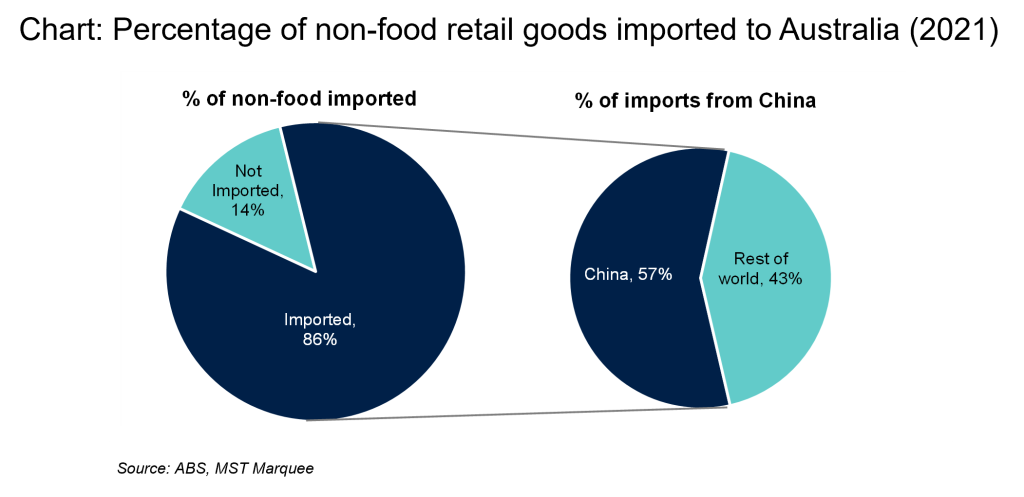

Reliance on China

24 September 2022

The Retail Mosaic Issue 4

The role of China in Australian retail - the risks and benefits in offshore sourcing

13 September 2022

Search result for "" — 362 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.