Toggle intro on/off

Price Watch Issue 6 - Retail price drivers

The lead indicators for retail prices

07 July 2023

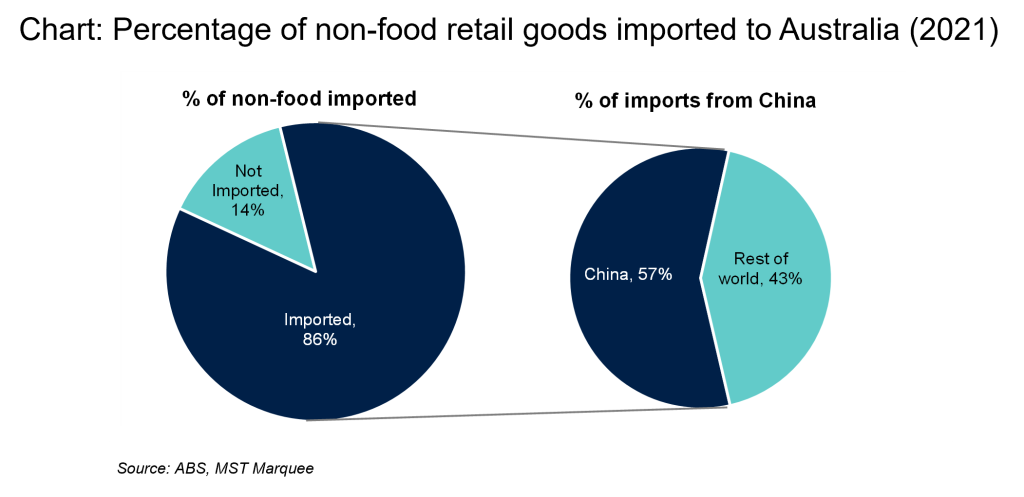

The need to diversify supply chains for Australian retailers

Reliance on China

24 September 2022

Search result for "" — 362 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.