Toggle intro on/off

Australian wine exports - June 2024 quarter

China sell-in is strong

04 August 2024

Treasury Wines (TWE) - Penfolds pricing power

Plotting the path for Penfolds earnings

26 June 2024

Lovisa (LOV) - CEO succession plan update

Out with the old, in with the new

06 June 2024

Lovisa (LOV) - Initiation of coverage

Is the growth in bling priced in?

11 April 2024

Treasury Wine (TWE) - 1H24 result analysis

Focus on luxury

19 February 2024

Treasury Wine (TWE) DAOU acquisition announcement

Remixing its US wine business

03 November 2023

Treasury Wine Estates (TWE) - The upside in China

Framework for China tariff removal

09 August 2023

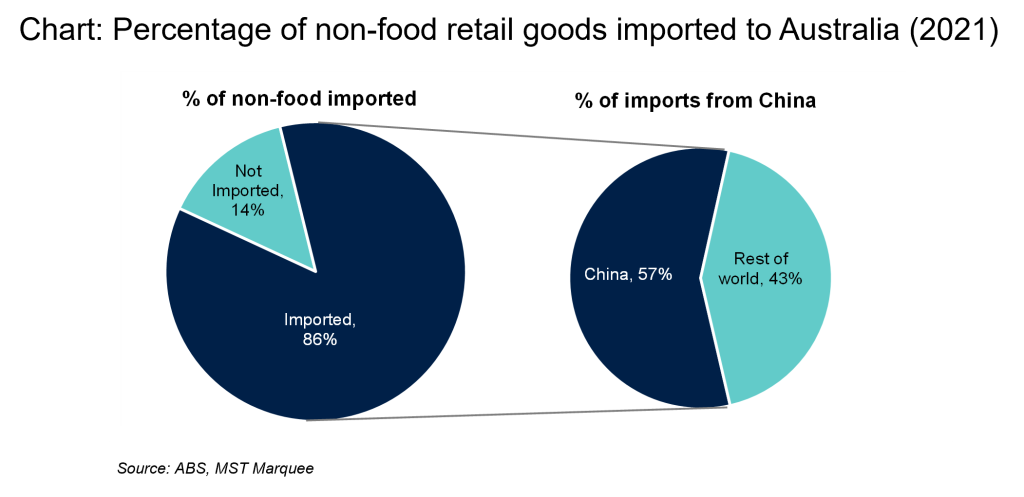

The need to diversify supply chains for Australian retailers

Reliance on China

24 September 2022

The Retail Mosaic Issue 4

The role of China in Australian retail - the risks and benefits in offshore sourcing

13 September 2022

Treasury Wine Estates (TWE) meeting with management

Treasury Premium Brands upside

30 March 2022

Search result for "" — 397 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.