Toggle intro on/off

Treasury Wine (TWE) DAOU acquisition announcement

Remixing its US wine business

03 November 2023

Treasury Wine Estates (TWE) - The upside in China

Framework for China tariff removal

09 August 2023

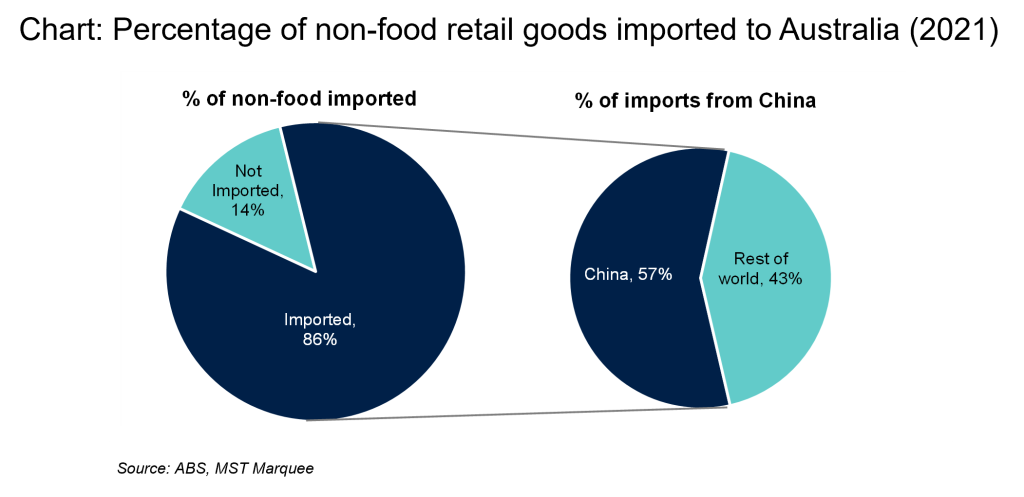

The need to diversify supply chains for Australian retailers

Reliance on China

24 September 2022

The Retail Mosaic Issue 4

The role of China in Australian retail - the risks and benefits in offshore sourcing

13 September 2022

Treasury Wine Estates (TWE) meeting with management

Treasury Premium Brands upside

30 March 2022

Treasury Wine Estates (TWE) feedback from meeting with management

Penfolds plans for growth

01 December 2021

Treasury Wine Estates (TWE) FY21 result

Encouraging Signs of Stabilisation

20 August 2021

Treasury Wine Estates (TWE) initiation

Plotting The Recovery Path

12 August 2021

Search result for "" — 473 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.