Toggle intro on/off

Our take on the FY26e Federal Budget

Election year budget for consumers

28 March 2025

Our take on the FY25e Federal Budget

Will tax cuts boost retail?

16 May 2024

Australian retail - Christmas outlook 2023

Santa to deliver a soft landing

15 December 2023

Bapcor Ltd (BAP) trading update

Earnings may not be better than before just yet

19 October 2023

Retail Mosaic chart pack August 2023

Insights about retail spending and profitability

11 August 2023

National accounts for Dec '22 quarter

A new normal emerging

01 March 2023

National accounts for Sept ’22 quarter

Income slowdown begins

07 December 2022

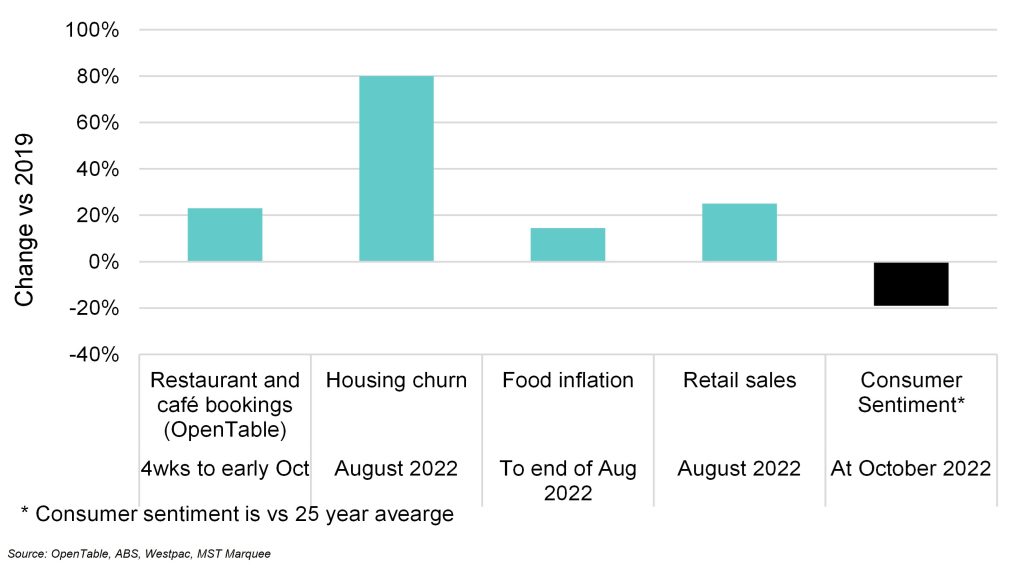

Measuring consumer behaviour vs consumer sentiment

The potential disconnect

12 October 2022

Australian national accounts for September 2021 quarter

Higher income, lower spending

01 December 2021

Australian national accounts for June 2021 quarter

Healthy income growth underpins retail spending

01 September 2021

Search result for "" — 473 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.