Toggle intro on/off

Super Retail October trading update shows strong trends

Sales boom continues for now

31 October 2022

JB Hi-Fi 1Q23 sales insights

Double-digit growth now over

31 October 2022

Coles 1Q23 result insights

A low point in sales growth

28 October 2022

Inflation for the September 2022 quarter

Price rises move beyond the sweet spot

26 October 2022

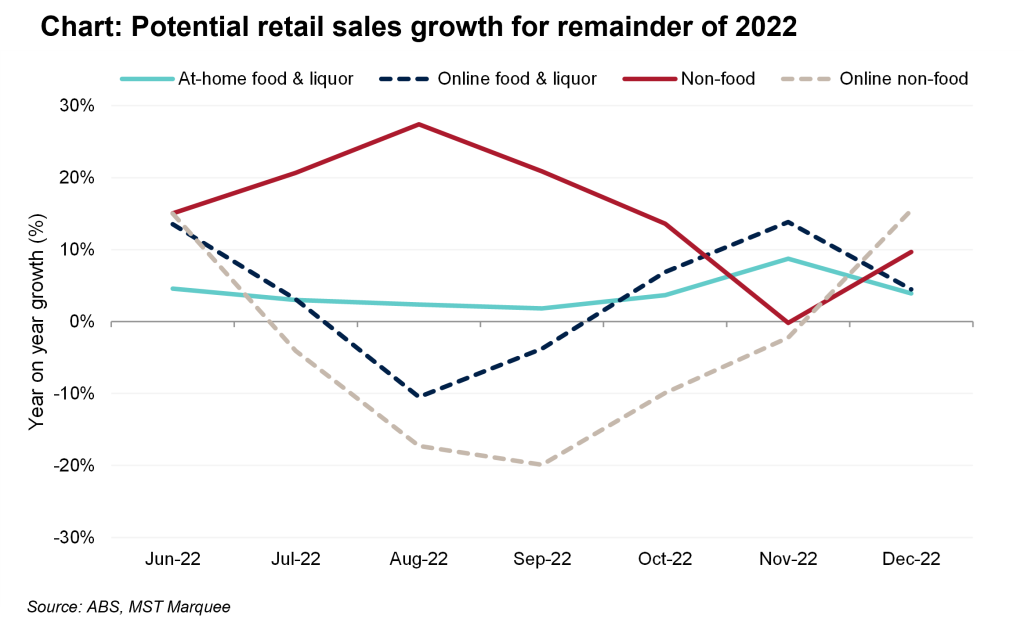

Retail sales outlook for remainder of 2022

What to expect over coming months

21 October 2022

Costa Group October 2022 trading update - Update for citrus and mushroom site tour

A taste for citrus will return

20 October 2022

Endeavour Group 1Q23 sales result

Looking through lockdowns

19 October 2022

Metcash October 2022 strategy day

More growth with more capex

19 October 2022

Quarterly update: Retail sales forecasts for FY23e

Don’t dismiss the influence of inflation

16 October 2022

Metcash - Strategy day preview

New CEO’s opportunity to set agenda

15 October 2022

Search result for "" — 387 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.