Toggle intro on/off

Australian retail sales for January 2023

Shift within the retail wallet

07 March 2023

Retail sales for December 2022

First signs of slowdown emerging

06 February 2023

Retail sales for November 2022

Leaping a high hurdle

15 January 2023

Tourism and population recovery of sorts

A path towards normalisation

13 December 2022

The Retail Mosaic Issue 5

Australia vs New Zealand retailing - Are there parallels across the ditch?

10 December 2022

Our view on Christmas 2022

Joyful retailers this year

09 December 2022

Retail sales for October 2022

Moderating lockdown distortions

05 December 2022

Retail sales for September 2022

Online normalisation continues

05 November 2022

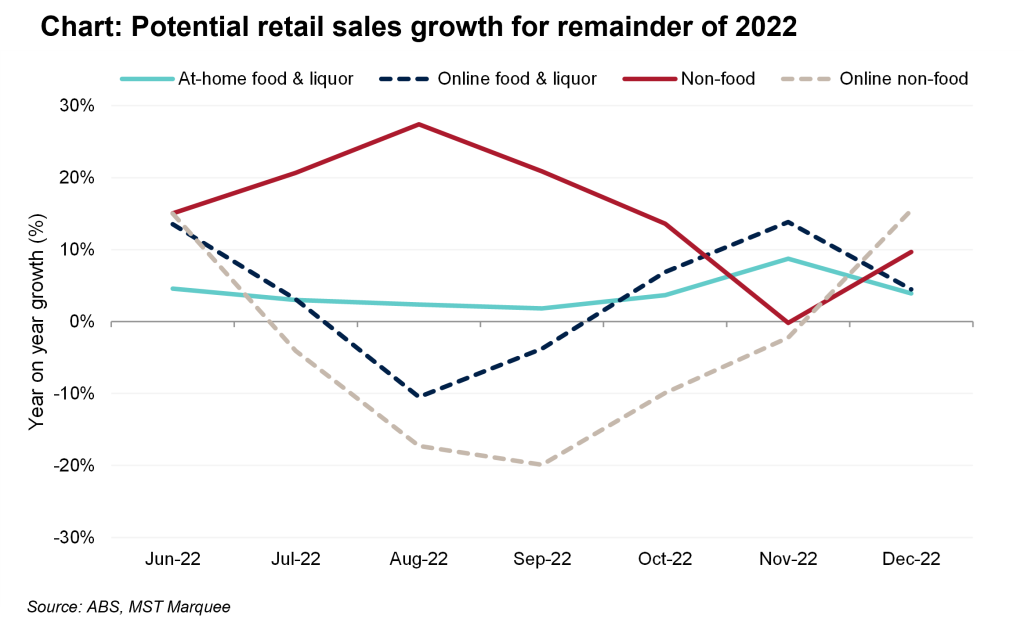

Retail sales outlook for remainder of 2022

What to expect over coming months

21 October 2022

Retail sales for August 2022

Online sales decline

06 October 2022

Search result for "" — 471 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.