Toggle intro on/off

US tariff impact on Australian consumer companies

A blessing or a curse?

04 April 2025

JB Hi-Fi (JBH) - 1H25 result analysis

Margins matter most

18 February 2025

Inflation for the December 2024 quarter

Lower interest rates coming soon

04 February 2025

JB Hi-Fi (JBH) - Exploring the upside and downside risks

What justifies $90?

25 November 2024

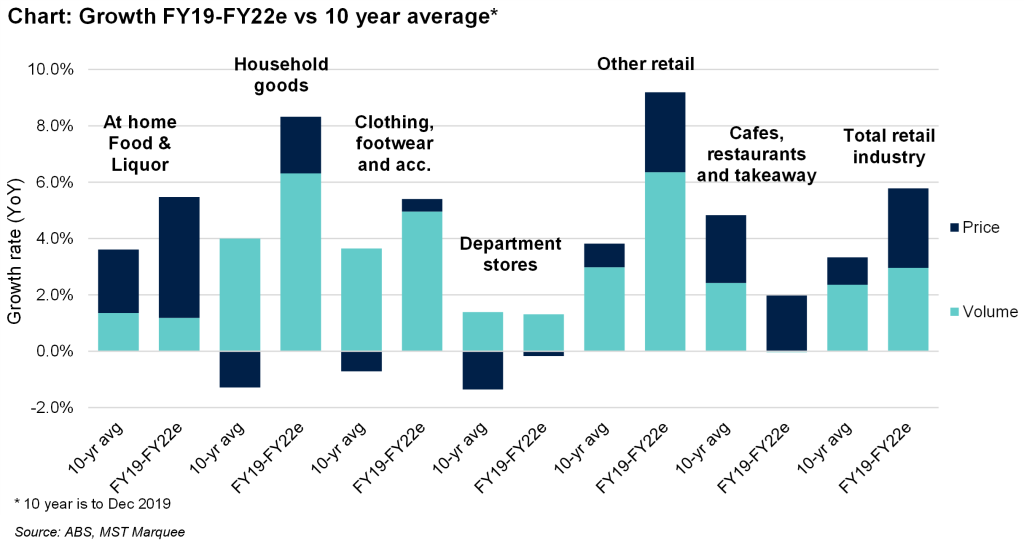

The contribution of price to revenue growth in retail

What mean reverts, price, volume or both?

05 August 2022

Search result for "" — 471 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.