Toggle intro on/off

Retail Mosaic Issue 8

The impact of immigration on retail

15 March 2024

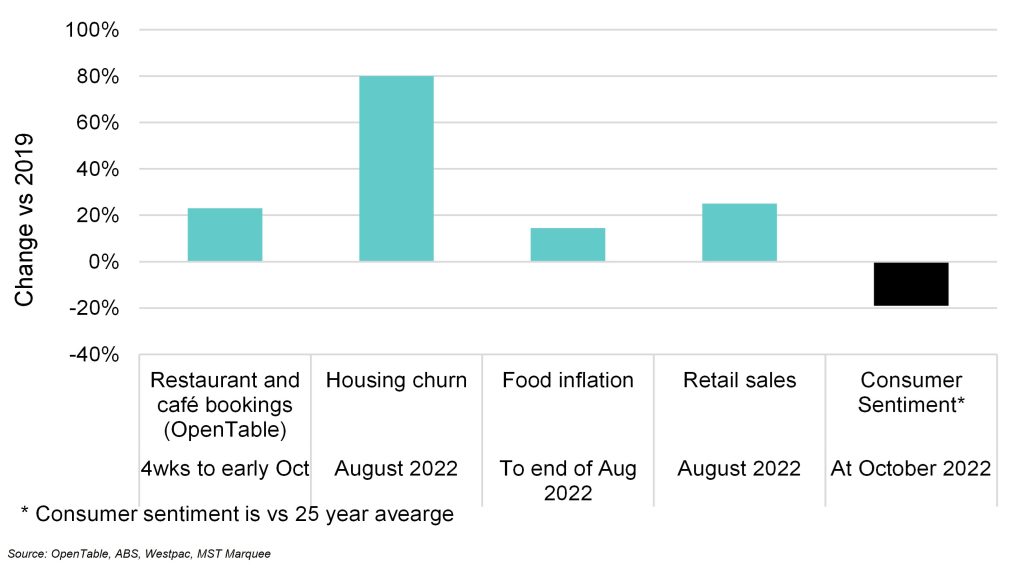

Measuring consumer behaviour vs consumer sentiment

The potential disconnect

12 October 2022

National accounts for June ’22 quarter

Income growth accelerating

08 September 2022

Search result for "" — 481 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.