Toggle intro on/off

Inflation for the December 2022 quarter

Have retail price rises peaked?

31 January 2023

Retail forecasts for 2023

Brace for impact this year

11 January 2023

Coles 1Q23 result insights

A low point in sales growth

28 October 2022

Coles (COL) FY22 result

COVID unwind to boost margins

26 August 2022

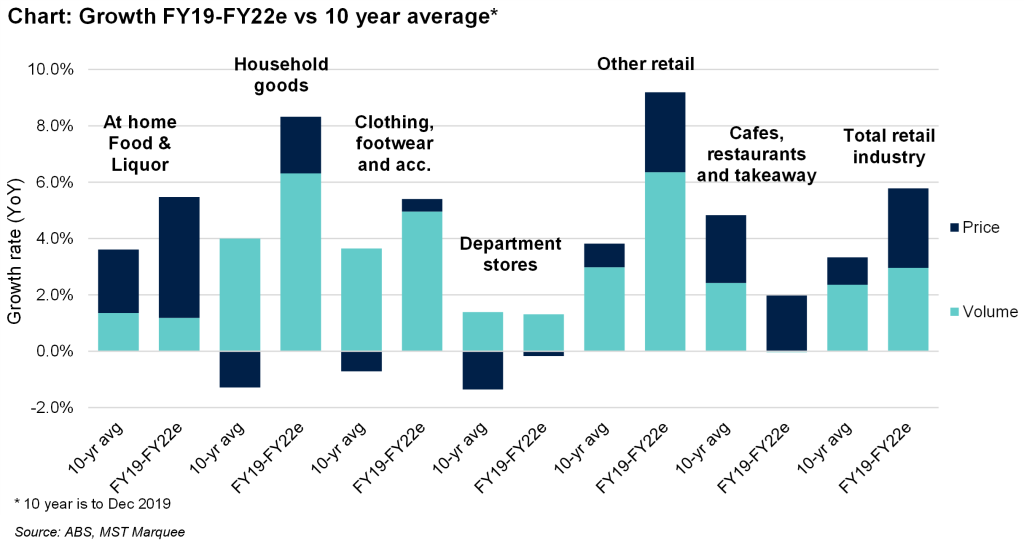

The contribution of price to revenue growth in retail

What mean reverts, price, volume or both?

05 August 2022

Search result for "" — 453 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.