Toggle intro on/off

Retail sales for January 2024

Subdued sales growth

11 March 2024

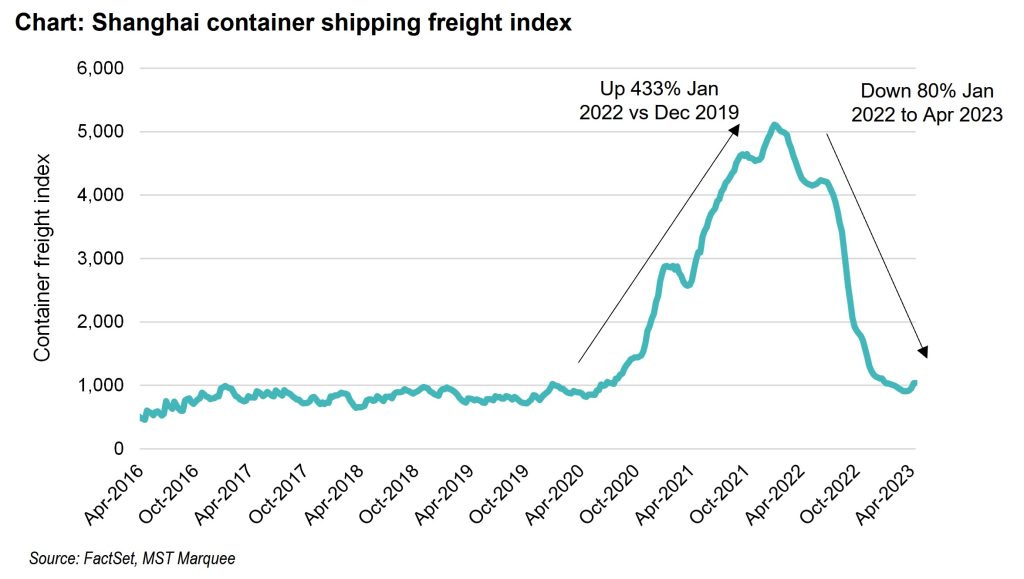

Shipping costs fall back to 2019 levels

The impact on retail inflation

24 April 2023

Search result for "" — 471 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.