Toggle intro on/off

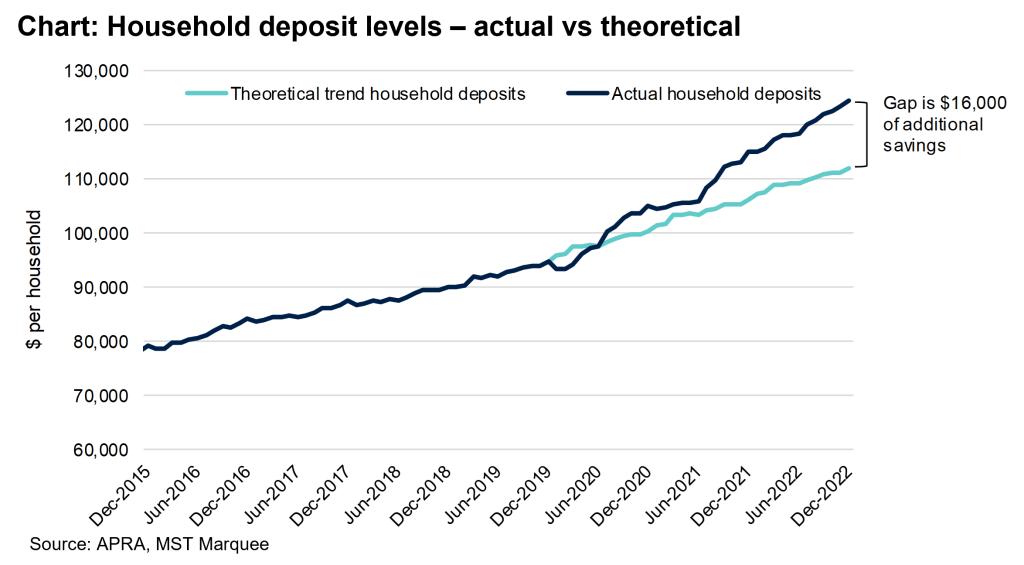

Elevated household deposits support consumer spending

Data from the banking regulator

07 February 2023

Retail forecasts for 2023

Brace for impact this year

11 January 2023

National accounts for Sept ’22 quarter

Income slowdown begins

07 December 2022

National accounts for June ’22 quarter

Income growth accelerating

08 September 2022

Australian national accounts for March 2022 quarter

Sizing the financial buffer for consumers

01 June 2022

Australian national accounts for December 2021 quarter

A picture of health

02 March 2022

Australian national accounts for September 2021 quarter

Higher income, lower spending

01 December 2021

Search result for "" — 386 articles found

Not already a member?

Join now to get all the latest reports in full and stay informed.